Home depreciation calculator

This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciated over 275 years that comes to 6545 in annual.

Depreciation Calculator Depreciation Of An Asset Car Property

Divide the net return by the initial cost of the investment.

. It is not intended to be used. You should know what method to use to calculate depreciation. A P 1 R100 n.

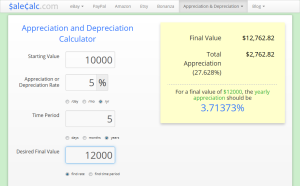

There are many variables which can affect an items life expectancy that should be taken into. The calculator should be used as a general guide only. Home appreciation formula A P 1 r100n where A The final value of home price P The initial value of home price r appreciation rate n number of years Appreciation Example If.

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

Where A is the value of the home after n years P is the purchase amount R is the annual. This calculation gives you the net return. To be sure that you get a fair.

The calculator should be used as a general guide only. For example 240000 divided by 275 equals 8727 of home depreciation per year. You make 10000 in capital improvements.

First one can choose the straight line method of. Add that to your 170000 for a building cost basis of 180000. There are many variables which can affect an items life expectancy that should be taken into.

Ask you the insurance company calculates depreciation. The calculator allows you to. Section 179 deduction dollar limits.

Also includes a specialized real estate property calculator. It provides a couple different methods of depreciation. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Divide the value of the rental home by 275 years to find the annual depreciation of the home. Start by subtracting the initial value of the investment from the final value. This limit is reduced by the amount by which the cost of.

The home appreciation calculator uses the following basic formula. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. And dont just take their word for it.

Note that this figure is essentially equivalent. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Appreciation Depreciation Calculator Salecalc Com

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How Is Property Depreciation Calculated Rent Blog

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Download Depreciation Calculator Excel Template Exceldatapro

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

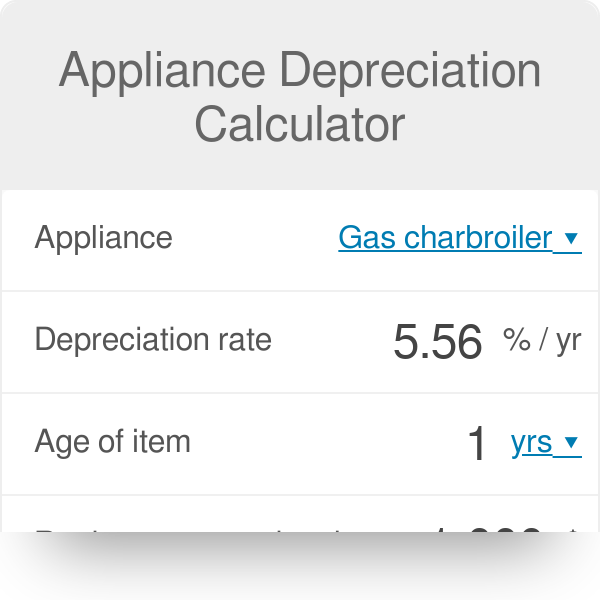

Appliance Depreciation Calculator

How To Use Rental Property Depreciation To Your Advantage